Newest

-

Changsha’s Tianxin District Celebrates Lantern Festival with Four-City Historic Tower Light Linkage

-

Xun County, C China's Henan: Young Artisans in "Hometown of Stone Carving" Bring Millennium-Old Craft to Life

-

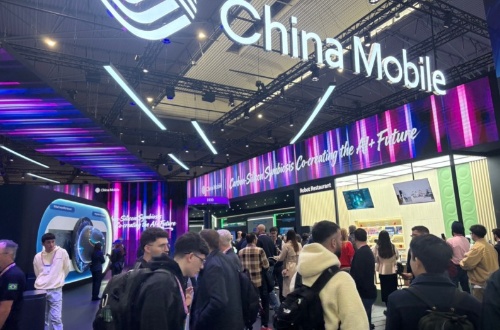

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

LOOP Finance: A Financial Institutional Experiment in the Web3 Republic

2025-08-06

2025-08-06

LOOP Finance is a fixed-investment DEFI investment protocol built on the Binance Smart Chain (BNB Chain).

Inspired by Keynesian economics, it offers a new approach to DEFI that provides long-term, secure, and stable returns, balancing robust interest returns with the potential for rapid DEFI growth.

Through its ecosystem mechanism, LOOP requires each participant to contribute a certain percentage of liquidity as a threshold for investment. This not only stabilizes the token price but also enhances the project's risk resistance and liquidity, making LOOP a low-risk, highly liquid DEFI asset.

LOOP is a deflationary token whose growth is driven by the LOOP Finance ecosystem. Its value growth logic is based on a closed-loop mechanism: "Participation leads to destruction, returns are determined by structure, and value is generated through circulation":

1. Investing in LOOP automatically destroys tokens, reducing circulation.

2. Investors earn points, which can be redeemed for USDT.

3. Points are generated from subsequent inflows, creating a continuous internal cycle of value.

4. Adding LPs increases quotas and profit rights, increasing market depth and stabilizing the price.

5. NFT governance and staking mechanisms are tied to LPs, suppressing selling pressure and increasing token retention.

6. DAO mechanisms and dividend distribution rewards encourage long-term community development.

LOOP Finance does not rely on external funding to drive the price of the token. Instead, it relies on internal mechanisms designed to transform the actions of participants in each round into a driving force for token value growth.

The more participants, the more tokens are destroyed, the faster the cycle, and the higher the value of the token.

https://t.me/+gCsTzWlOB9o3NTNl