Newest

-

Dreame Pens a ‘Love Letter to the World’ with Spring Festival Gala Partnership and Times Square Debut

-

Chinese humanoid robots gallop towards consumer market

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

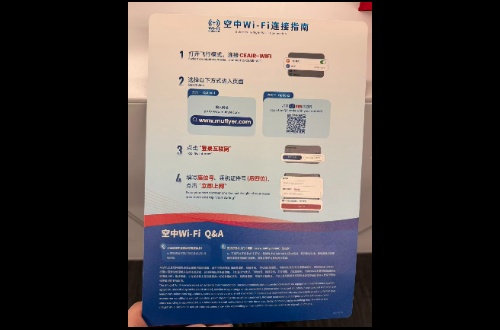

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

How Fintech is Changing Investment

2025-02-24

HaiPress

2025-02-24

HaiPress

Financial technology is transforming economies worldwide. From digital payments to blockchain and algorithm-driven trading, fintech is reshaping traditional finance. These innovations make financial services faster, more efficient, and accessible to a wider audience. Around the world, businesses and individuals rely on technology to streamline transactions, reduce costs, and improve investment opportunities. The shift toward digital financial solutions are no longer a trend. It is now a key driver of economic growth.

For emerging economies, fintech plays an even bigger role. Many countries struggle with outdated banking systems and limited financial access. In South Asia, financial technology is helping bridge these gaps. Digital banking, online investments, and AI-driven financial tools are making economic participation easier. Pakistan, with its growing tech adoption and young population, is at the centre of this transformation. The government is promoting financial inclusion through policies that encourage innovation. As the country embraces digital finance, opportunities for global fintech companies are expanding.

Beyond investment, fintech is driving broader economic change. Digital lending platforms, mobile wallets, and decentralized finance (DeFi) are empowering individuals and businesses by providing access to previously unavailable financial services. In Pakistan, digital payment systems such as RAAST ID, the government-backed instant payment system, are increasing financial inclusion. Startups and established fintech firms alike are contributing to this digital revolution, creating jobs and fostering innovation. As the regulatory landscape adapts, fintech adoption is expected to accelerate, bringing more people into the formal economy.

The integration of smart contracts, machine learning in trading, and the expansion of mobile financial services are just a few areas that could reshape the country’s economic outlook.

As financial markets continue to evolve, Pakistan’s ability to adapt will shape its economic future. The presence of global fintech firms like Scale Technology reflects a shift toward digital finance. In the next ten years, Scale is all set to expand its operations. With increasing investment in financial technology, Pakistan has an opportunity to modernize its economy.

The right policies, partnerships, and innovations will determine its success. The future of finance is digital, and fintech-driven growth could reshape investment opportunities for years to come.

In the coming years, Pakistan could see an increase in blockchain-based solutions, AI-powered investment platforms, and even central bank digital currencies (CBDCs). These developments could further democratize financial access, making wealth generation more inclusive. With a rising number of young entrepreneurs and tech-savvy investors, the demand for fintech services is expected to grow exponentially. Whether through regulatory support, private-sector innovation, or public awareness campaigns, the nation’s fintech journey is just beginning.

By fostering an ecosystem that encourages collaboration between fintech firms, banks, and policymakers, Pakistan can establish itself as a key player in the digital financial landscape. The integration of smart contracts, machine learning in trading, and the expansion of mobile financial services are just a few areas that could reshape the country’s economic outlook. As fintech continues to evolve, Pakistan has a unique opportunity to leverage digital transformation for sustainable economic growth.