Newest

-

Dreame Pens a ‘Love Letter to the World’ with Spring Festival Gala Partnership and Times Square Debut

-

Chinese humanoid robots gallop towards consumer market

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

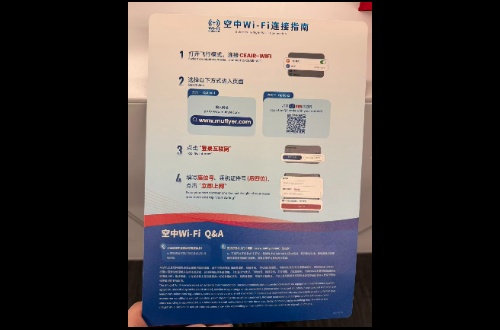

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

CPIC P/C: Contributing to High-Quality Development of the Greater Bay Area through Insurance Innovation

2024-12-24

2024-12-24

China Pacific Insurance (Group) Co., Ltd

HaiPress

China Pacific Insurance (Group) Co., Ltd

HaiPress

SHANGHAI,Dec. 22,2024 -- In December 2024,China Pacific Insurance Company (CPIC) celebrates the 15th anniversary of its H-share listing.

Under the guidance of China's "14th Five-Year Plan" and its 2035 Long-Range Objectives,which set a clear direction for the insurance industry,CPIC P/C aligns itself with the "dual-circulation" New Development Paradigm,vigourously supports national strategies of integrated regional development,and steadily promotes its internationalization. The Greater Bay Area (GBA) is precisely the focus of all such efforts.

In 2021,CPIC formulated the 3-Year Action Plan for Development in the Greater Bay Area (2021-2023),which positioned the GBA as a "high ground of innovation" to drive high-quality development of the company.

To boost high-quality development of the area,CPIC continued with innovation,optimised resource allocation,and fully mobilised local branch offices to support the GBA in an all-around way as the forefront of China's social and economic development.

Strengthening collaboration in innovation to enhance customer experience

The Shenzhen branch of CPIC P/C capitalised on infrastructure investment opportunities outlined in the strategic planning of "Hong Kong 2030+". It worked with CPIC Hong Kong and strengthened cooperation with local Chinese-funded enterprises. Under the partnership,CPIC Hong Kong provides u/w capacity,issues insurance policies,handles claims and settles premium funds for Chinese-funded Hong Kong customers of the Shenzhen branch; and in the process it grows business and improves visibility in the GBA. On the other hand,the Shenzhen branch fully leverages CPIC Hong Kong as an important window of international business,forms close partnership with it in reinsurance,particularly in term of gaining access to global reinsurance capacity and obtaining more insights into market trends and dynamics.

CPIC P/C will leverage Hong Kong as an international financial centre to boost localised product innovation for overseas markets and drive overseas business development,such as insurance for local e-commerce platforms and extended warranty for overseas motor vehicles. It will enhance cooperation with local insurers in new products,including exploring ways to introduce competitive products in China's mainland to local markets,as well as cooperation in cross-border data and fund settlement for e-commerce platforms. Its Shenzhen branch and CPIC Hong Kong will also heighten resource-sharing and cooperation in policy issue networks. The latter will assist in the entire process of customer service for the Belt & Road projects to improve efficiency and customer satisfaction.

Building a comprehensive cross-border insurance system to support international expansion of Chinese enterprises

As China becomes more international and the mix of its domestic trade improves,there has been robust demand for cross-border e-commerce and transport,international tourism and international information-processing and dissemination. In such a context,a comprehensive cross-border insurance solution has gradually come to the fore,including customs duty bond,export credit insurance,cross-border e-commerce insurance,cross-border logistics insurance,cross-border tourism insurance and vendor liability insurance,etc. On the occasion of the 2024 World Annual Conference on Cross-Border E-Commerce Platforms (Hengqin,Zhuhai) in Guangdong,CPIC joined hands with Zhuhai Municipal Government and unveiled a comprehensive cross-border insurance system which offers one-stop service to domestic companies to facilitate their internationalization efforts.

To date,the Guangdong branch has partnered with seven customs offices in the province,issuing over 7.7bn yuan in customs bond guarantee for 119 enterprises,significantly reducing customs clearance costs and improving its efficiency; provided cumulatively 27.8bn yuan in risk cover for account receivables to 729 companies,contributing to the "dual-circulation" New Development Paradigm.