Newest

-

Dreame Pens a ‘Love Letter to the World’ with Spring Festival Gala Partnership and Times Square Debut

-

Chinese humanoid robots gallop towards consumer market

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

Global Semiconductor Manufacturing Industry Records Strong Growth in Q3 2024, SEMI Reports

MILPITAS,Calif.,Nov. 19,2024 --The globalsemiconductor manufacturing industry in the third quarter of 2024 showed strong momentum with all key industry indicators performing positive quarter-on-quarter (QoQ) increases for the first time in two years,SEMI announced today in its Q3 2024 publication of the Semiconductor Manufacturing Monitor (SMM) Report,prepared in partnership with TechInsights. The growth is fueled by seasonal factors and strong demand from investments in AI data centers,however,the consumer,automotive,and industrial segments are experiencing a slower pace of recovery. The growth trend is expected to continue into the fourth quarter of 2024.

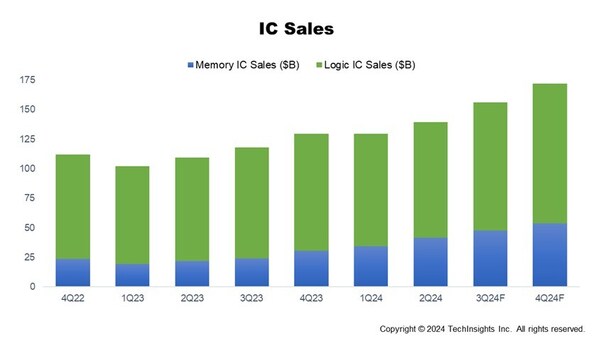

After declining in the first half of 2024,electronic sales rebounded in Q3 2024,growing 8% QoQ,with a projected QoQ increase of20% in Q4 2024. IC sales also rose by 12% QoQ in Q3 2024 and are expected to grow another 10% in Q4 2024. Overall,IC sales are forecasted to increase over 20% in 2024,primarily driven by memory products due to price improvement across the board and strong demand for data center memory chips.

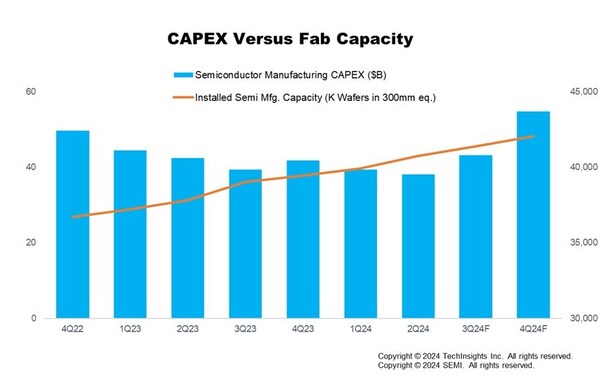

Similar to the electronics sales,semiconductor capital expenditures (CapEx) decreased in the first half of 2024,but the trend is turning positive starting in Q3 2024. Memory-related CapEx is surging 34% QoQ and 67% year-on-year (YoY) in Q3 2024 reflecting improvement in the memory IC market compared to the same period of the last year. In Q4 2024,total CapEx is expected to jump 27% relative to Q3 2024 levels and 31% YoY,with memory-related CapEx leading this growth at 39% YoY.

The semiconductor capital equipment segment remains strong and is performing better than previously expected due to substantial investments from China and increased spending for high-bandwidth memory and advanced packaging. Wafer Fab Equipment (WFE) spending increased 15% YoY and 11% QoQ in Q3 2024. China's investment continues to play a significant role in theWFE market. Additionally,both the Test and the Assembly and Packaging segments experienced impressive YoY increases of 40% and 31%,respectively,in Q3 2024,and this growth is anticipated to continue for the remainder of the year.

In Q3 2024,installed wafer fab capacity reached 41.4 million wafers per quarter (in 300mm wafer equivalent) and is projected to rise by 1.6% in Q4 2024. Foundry and Logic-related capacity continues to show stronger increases,growing 2.0% in Q3 2024 and is projected to rise 2.2% in Q4 2024 driven by capacity expansion for both advanced and mature nodes. Memory capacity increased 0.6% in Q3 2024 and is forecasted to maintain the same pace of growth in Q4 2024. This growth is driven by strong demand for high bandwidth memory (HBM) but is partially offset by process node transitions.

"The semiconductor capital equipment segment continues to exhibit growth momentum,bolstered this year by strong investments from China and increased spending on advanced technologies," said Clark Tseng,Senior Director of Market Intelligence at SEMI. "Additionally,the continued expansion of fab capacity,especially in the foundry and logic segments,underscores the industry's commitment to meeting the growing demand for advanced semiconductor technologies."

"2024 has shown two sides within the semiconductor industry," said Boris Metodiev,Director of Market Analysis at TechInsights. "While consumer,and industrial markets have struggled,AI has thrived,boosting average selling prices in memory and logic products. As interest rates decrease heading into 2025,consumer sentiment is expected to improve,encouraging larger purchases and supporting both the consumer and automotive markets."

Global Semiconductor Manufacturing Industry Records Strong Growth in Q3 2024,SEMI Reports

Sources: SEMI (www.semi.org) and TechInsights (www.techinsights.com),November 2024

The Semiconductor Manufacturing Monitor (SMM) report provides end-to-end data on the worldwide semiconductor manufacturing industry. The report highlights key trends based on industry indicators including capital equipment,fab capacity,and semiconductor and electronics sales,and includes a capital equipment market forecast. The SMM report also contains two years of quarterly data and a one-quarter outlook for the semiconductor manufacturing supply chain including leading IDM,fabless,foundry,and OSAT companies. An SMM subscription includes quarterly reports.

Download a sample of the Semiconductor Manufacturing Monitor report.

For more information on the report or to subscribe,please contact the SEMI Market Intelligence Team atmktstats@semi.org. Details on SEMI market data are available at SEMI Market Data.

About SEMI

SEMI®is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide across the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration on solutions to top industry challenges through Advocacy,Workforce Development,Sustainability,Supply Chain Management and other programs. Our SEMICON®expositions and events,technology communities,standards and market intelligence help advance our members' business growth and innovations in design,devices,equipment,materials,services and software,enabling smarter,faster,more secure electronics. Visitwww.semi.org,contact a regional office,and connect with SEMI onLinkedInandXto learn more.

Association Contact

Samer Bahou/SEMI Corporate

Phone: 1.408.943.7870

Email:sbahou@semi.org

2024-11-20

2024-11-20