In recent years, the world has ushered in a new era of financial inclusion and simplified financial service infrastructure, and cryptocurrencies have also gained popularity. The outbreak of the COVID-19 has become the main force to promote the development of the encryption field. The continued epidemic of the global epidemic has caused certain impacts on all aspects of our lives, and these impacts will shape our future.

The outbreak of COVID-19 has highlighted the shortcomings of the economy in terms of efficiency and transparency. However, the emergence of blockchain technology has provided a good solution for the current epidemic (medical aspect). In addition, the epidemic has also had a significant and far-reaching impact on the financial sector. Governments around the world have started printing massive amounts of money during the Covid-19 pandemic, raising new concerns about the health of the financial sector and prompting a shift to cryptocurrencies as alternative assets. So, unlike the 2017 bubble, cryptocurrencies (in the case of Bitcoin) have proven themselves to be a hedge against inflation, while strengthening their status as a store of value. Institutional investors, hedge funds, and other established financial investment institutions, such as MicroStrategy, Square, and PayPal, have all entered the crypto space. This shows that the crypto space will continue to accelerate growth and will attract more new retail and institutional investors.

Advantages of cryptocurrencies

1. Complete Decentralization

Encrypted digital currency is completely decentralized, there is no issuer, and the amount of issuance cannot be manipulated. Any related industries and institutions have no right and cannot close it. The price of cryptocurrencies may fluctuate, but those who own cryptocurrencies and those who use cryptocurrencies to trade and circulate will not disappear.

2. Stay away from inflation

Currencies all over the world face inflation as governments print a lot of money, but this is not possible in cryptocurrencies. The total amount of any cryptocurrency is fixed before it is mined. Like Bitcoin, only 21 million Bitcoins can be mined and no one can increase its amount. So, cryptocurrencies are always far from inflation.

3. Efficient circulation

Cryptocurrencies know no borders. When traditional cross-border trade transfers and remittances, in addition to going through layers of foreign exchange control agencies, it is also often affected by the policies and laws of various countries and regions, making the entire transfer process time-consuming and poor experience. Cryptocurrencies enable users in different countries and regions in the world to achieve efficient transmission. Stores use encrypted digital currency transactions, which can save the cost of taxation and capital supervision and a lot of handling fees, and the global circulation is very convenient.

4. More transparent and secure

The encrypted digital currency adopts a distributed ledger and has a smart contract as a credit endorsement, so the probability of financial risk is extremely low. In addition to that, with the help of blockchain, users can check all transactions. Every transaction is made through an anonymous identity, so we can easily track whether there is any fake or theft.

About Barbizon

Barbizonfinance Cryptocurrency fund Investment started in 2018 as a product line offering investors an investment category for digital currency assets.

In January 2022, Barbizonfinance Cryptocurrency fund investment platform Barbizon.io is getting a new makeover, officially renamed Barbizonfinance Cryptofund (BC), with the simultaneous opening of WEB PC and APP.

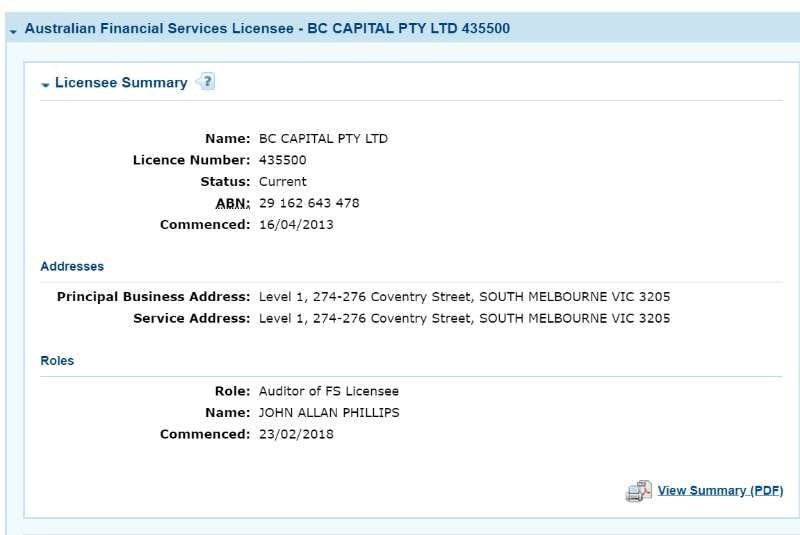

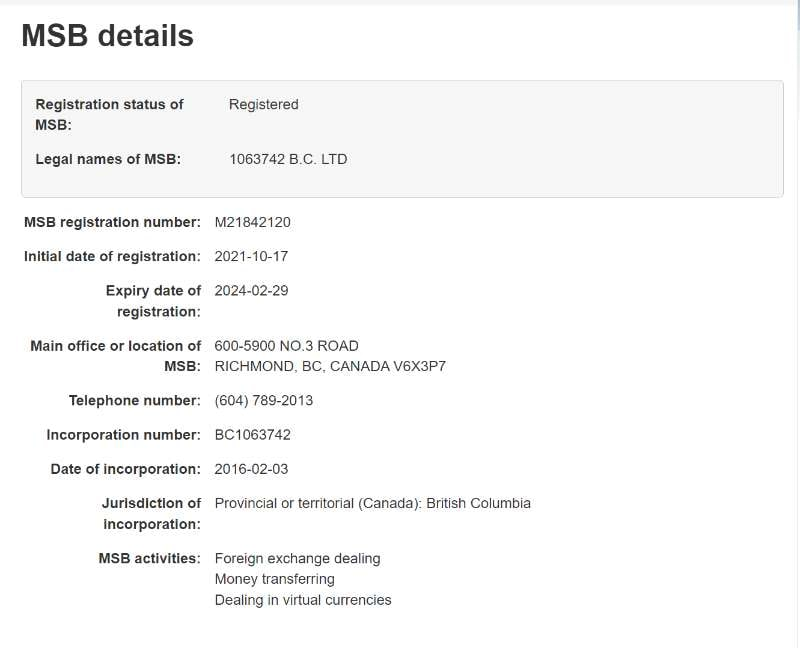

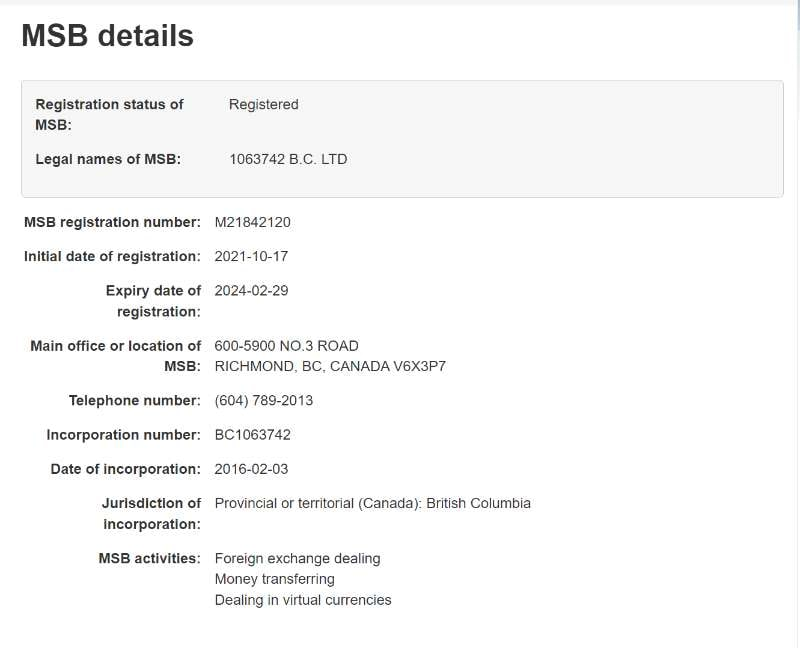

Barbizonfinance Cryptofund (BC) is a professional cryptocurrency project investment brand established under Barbizonfinance, with legal financial licenses: the Australian company BC CAPITAL PTY LTD received the Australian financial services license in 2018, and the Canadian company 1063742 B.C. LTD received the Canadian MSB financial license in 2021. The team has years of cutting-edge financial analysts and quantitative teams dedicated to providing safe and convenient investments for wealthy value investors and those who lack investment experience.

Barbizon Financial license(BC : barbizon Crypto)

Why Barbizonfinance Cryptofund (BC) chooses active funds

Cryptocurrencies have boomed over the past two years, and more traditional financial industries have invested in cryptocurrencies, even launching products such as cryptocurrency funds. The emergence of these products provides options for non-specialist users who want to invest in the cryptocurrency industry. As a cryptocurrency investment fund company, Barbizonfinance Cryptofund (BC) differs from traditional cryptocurrency investment funds in that we offer actively managed fund services to our clients.

1.No need to make your own investment strategy

The investment manager of passive funds is only responsible for fitting the tracked index and controlling the tracking deviation. Therefore, the specific choice of which index to invest in and the timing of investment need to be grasped by the fund investors themselves.But active funds are generally allocated according to the direction of the fund's investment, the type of investment, and the investment strategy of the fund manager.

2.Active funds are more flexible.

Active fund positions will fluctuate with the stock market, and the positions are more flexible. Taking stock/partial stock funds as an example, the stock positions of active funds are generally between 40% and 100%, and there is a lot of room for position adjustment, and fund managers can adjust positions and exchange shares at any time. On the contrary, due to the need to control the tracking error between passive funds and the tracked index, passive funds usually maintain high positions and cannot reduce positions at will, and are less flexible than active funds.

3.higher expected return

Active funds have more room to create excess returns, while passive funds' expected returns are closely linked to their performance benchmarks. The expected returns of passive funds are the expected returns of the tracking index.

The cryptocurrency market works very differently from the traditional financial markets. it runs 24/7 and there are no limits on the ups and downs, so the cryptocurrency market is far more volatile than the traditional financial markets. Therefore, if you are a layman who is not well versed in the workings of the cryptocurrency market, it is very difficult to make money in the cryptocurrency space. From this, we can conclude that Barbizonfinance Cryptofund (BC) has chosen to be an active cryptocurrency fund for the simple reason of outperforming the market, reducing the learning time for the average investor and making more money for them.

Why Investors Choose Barbizonfinance Cryptofund (BC)

Trusted & Secure

Since Barbizonfinance Cryptofund (BC) manages the tokens by itself, investors can obtain digital currency investment opportunities while entrusting Barbizonfinance Cryptofund (BC) to professionally keep the digital currency.

Familiar & Compliant Product Structures

Barbizonfinance Cryptofund (BC) has built transparent, familiar, and compliant investment products that operate within existing regulatory frameworks.

Diversified Exposure

In much the same way they would access other investment products,investors can add digital currencies to their brokerage accounts via Barbizonfinance Cryptofund (BC)’s single-asset and diversified products.

Why is it safe to invest with us?

● DDOS protection:We are protected from all types of DDoS attacks. Therefore, you can always access the site.

● Data encryption:Your data is protected and cannot be transferred to third parties.

● Database backup:We constantly backup databases, therefore all information about our investors is protected.

● Dedicated server:We have a dedicated server, this provides additional protection and reliability.

● Hacking protection:We are fully protected from viruses, hacking and any other actions by malicious users.

● SSL:Traffic of our site is encrypted my SSL certificate.

BarbizonFinance has launched 11 different investment classes for its customers. For example, a fund product like Bitcoin Trust will invest exclusively in Bitcoin. Investors simply choose the product they want to invest in and then invest. Barbizonfinance Cryptofund (BC)'s professional fund management team will work your assets wisely to maximize your returns.

Disclaimer: This article is reproduced from other media. The purpose of reprinting is to convey more information. It does not mean that this website agrees with its views and is responsible for its authenticity, and does not bear any legal responsibility. All resources on this site are collected on the Internet. The purpose of sharing is for everyone's learning and reference only. If there is copyright or intellectual property infringement, please leave us a message.

2022-01-13

2022-01-13