Newest

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

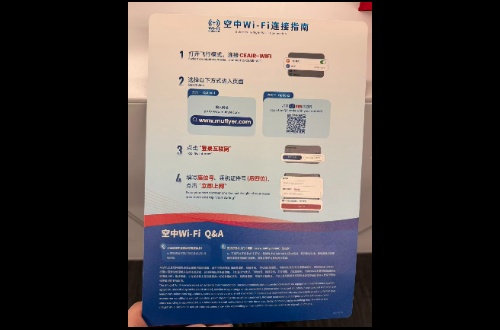

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

-

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

-

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning

XTransfer Enlarges Global Partnership Network, Offers Premium Cross-border Financial Services to SMEs

2020-09-25

2020-09-25

XTransfer

XTransfer

Cross-border financial services leader XTransfer taps into growing user base, stronger ties with industry leader

Shanghai, September 23 – As China's battered exports sector bounces back from the coronavirus impact, XTransfer, a leading cross-border financial services provider, has been picking up the pace to better serve small and medium-sized trading businesses.

The 3-year-old Shanghai-based startup specializes in offering cross-border payment and financial services for small-scale B2B e-commerce players.Through a data-driven, automated, internet-powered and intelligent risk management system, XTransfer has established a globally unified financial network that matches demand and supply within one single platform. Its varied solutions include opening a global and local payment collection account, foreign currency exchange and declaration of income in countries with a non-convertible currency, among other cross-border financial services.

According to statistics released by China's Ministry of Commerce, the country's exports between January and August edged up 0.8% year on year to 11.05 trillion yuan (US$1.58 trillion). Private trading firms took center stage as they accounted for 54.9% of total exports, up 3.8 percentage points.

Despite their strength and resilience, many SMEs have a low risk awareness. This has cost them access to proper banking services, including opening and maintaining an offshore bank account to collect trade payment. A flurry of shutdowns of bank accounts amid heightened regulatory concerns over the past few years left them high and dry.

As SMEs lead the rebound of China's export sector, XTransfer is in an overdrive to deliver its services to the most needy. To date, the company has served upwards of 70,000 clients, mostly SMEs, as they do business globally. These are among XTransfer's principal client base.

XTransfer has launched localized services in 16 cities across the nation, including Shanghai, Shenzhen, Guangzhou, Dongguan, Zhongshan, Foshan, Chaoshan, Ningbo, Hangzhou, Yiwu, Wenzhou, Suzhou, Wuxi, Xiamen, Quanzhou and Qingdao. To double down on localization, XTransfer has held six city-level foreign trade finance festivals since last year, with thousands of exporting firms attending. By diving deep into localization and getting closer to clients, XTransfer is able to offer services catering to real user demand.

In September, the firm pledged to redouble efforts to support local exporters at a summit in Ningbo, a key trading port in eastern China. In keeping with its commitment to take services to customers, XTransfer has built a professional service team in Ningbo, sending them on trips to visit local exporters and address their needs. Thousands of Ningbo-based exporters have chosen XTransfer as the provider of cross-border financial services.

Among them is Grace, a partner at Ningbo Bozhiwei International Trade Co. Ltd. With over a decade's experience in foreign trade, she said she had been collecting payment via XTransfer ever since she tried the service, citing the convenience it affords.

As the foundation of offering better services, XTransfer's globally unified financial network, in particular its AI-enabled, intelligent risk management capability, has won increasing recognition from banks and other financial institution.

The latest example of this is the deepening of strategic collaborations between XTransfer and Standard Chartered Hong Kong. This marked the formal launch of the XTransfer-Standard Chartered global payment collection account service.

With Standard Chartered joining a long list of XTransfer's existing banking partners, such as the Development Bank of Singapore, the Barclays Bank, The Currency Cloud, Community Federal Savings Bank and Citibank, XTransfer has completed another major milestone in its quest to expand the globally unified financial network.

The new service promises to offer payment collection services that are faster, more cost-effective and convenient, to the benefit of global trade and cross-border e-commerce as well.

The XTransfer-Standard Chartered global payment collection account will be opened one or two working days after application. It supports the collection of payment in US dollar, euro, HK dollar and renminbi. Each Standard Chartered account supports one currency and one can apply for a maximum four such accounts.

Going forward, XTransfer will strive to enlarge its global financial network in a bid to explore more possibilities in cross-border financial services and generate greater value for SMEs.

About XTransfer

XTransfer was founded in May 2017 by six ex-Ant Financial and Alibaba employees. XTransfer cooperates with banks from various countries to set up a globally unified B2B financial network and intelligent risk management system, and launches comprehensive solutions of various cross-border financial services, such as global account opening, foreign currency exchange, and foreign exchange declaration. XTransfer strives to remove the hurdle for small and medium-sized enterprises (SMEs) to enter the global market and improve their world-wide competitiveness.

Company Name: XTransfer

Contact Person: Kefei Wei

Email: kefei.wei@xtransfer.cn

Country: China

City: Shanghai

Website: https://www.xtransfer.cn/