Newest

-

Dreame Pens a ‘Love Letter to the World’ with Spring Festival Gala Partnership and Times Square Debut

-

Chinese humanoid robots gallop towards consumer market

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

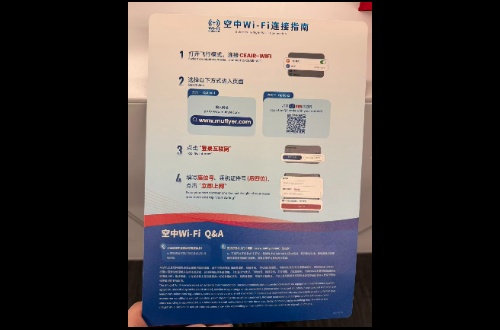

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

Kenwood Capital Management Forms Strategic Partnership with China International Capital Corporation (CICC) to Access China’s Block Trading Market via Stock Connect

2025-04-21

2025-04-21

New York, NY – [April 2025] — Kenwood Capital Management LLC, a U.S.-registered investment advisory firm, is pleased to announce the signing of a strategic agreement with China International Capital Corporation Limited (CICC), the designated global depositary receipt (GDR) cross-border conversion institution and one of China’s premier investment banks.

This partnership grants Kenwood direct access to the Chinese onshore equity market through the Hong Kong-Shanghai and Hong Kong-Shenzhen Stock Connect programs, enabling the firm to participate in block trades involving A-shares via the Northbound trading channel.

“This is a milestone in Kenwood’s Asia strategy,” said John Daniel Whitaker, President & CEO of Kenwood Capital Management. “Through this agreement with CICC, we gain institutional-level access to China’s equity market infrastructure — allowing us to execute large-scale allocations with precision, compliance, and strategic clarity.”

Leveraging Stock Connect for Cross-Border Block Trades

Under the agreement, Kenwood will utilize the Northbound Stock Connect channel to execute bulk trades and institutional rebalancing of Chinese A-shares. With CICC’s facilitation, Kenwood gains streamlined access and post-trade support for executing large transactions efficiently and securely.

This strategic step also aligns with Kenwood’s broader initiative to reallocate global exposure, particularly as a hedge against U.S. tariff-driven market volatility. The firm will increasingly target Chinese growth sectors such as technology, healthcare, infrastructure, and clean energy.

⸻

Understanding China’s Block Trading Framework

In China’s capital markets, block trading refers to negotiated, off-market transactions between qualified institutional investors. These trades are typically executed outside the main order book and allow participants to move significant positions discreetly and efficiently.

Key features of the system include:

Size thresholds:

The minimum transaction size depends on the stock’s closing price on the previous trading day:

If the closing price is ≤ RMB 200, the minimum volume is 500,000 shares

If the price is > RMB 200, the minimum trade size must be at least RMB 1 million in value

(For certain ETFs or illiquid securities, exchanges may set specific thresholds.)

Eligibility:

Participation is limited to institutional investors, qualified foreign institutional investors (QFII/RQFII), and entities trading under the Northbound Stock Connect program.

Execution and settlement:

Block trades are submitted through a separate trading mechanism and settled independently from the main auction system, typically on T+1. Information about trade volume and pricing is disclosed by the exchange after the market closes.

Block trading offers discretion, scale, and liquidity, making it an attractive mechanism for global asset managers with long-term investment horizons or rebalancing mandates. It allows for efficient execution of large orders without disrupting normal market prices — a feature particularly aligned with Kenwood’s AI-driven portfolio strategies, which prioritize market impact control, volatility awareness, and sector-specific precision.

Strategic Significance

This partnership will:

Empower Kenwood’s AI-driven investment models with seamless access to Chinese equities

Strengthen the firm’s exposure to Asia, particularly amid shifting global trade dynamics

Provide a scalable channel for cross-border execution and macro allocation

About Kenwood Capital Management

Kenwood Capital Management LLC is a U.S.-registered investment advisory firm (CIK: 0001352887), specializing in global macro strategies, quantitative investing, and long-term capital growth. With over $7 billion in assets under management, Kenwood serves institutional clients across North America, Europe, and Asia. The firm is headquartered in New York City, and is preparing to open a new research and strategy office in Frankfurt.

Contact: investor@kenwood.top

Website: www.kenwoodcapitalmanagement.com

⸻